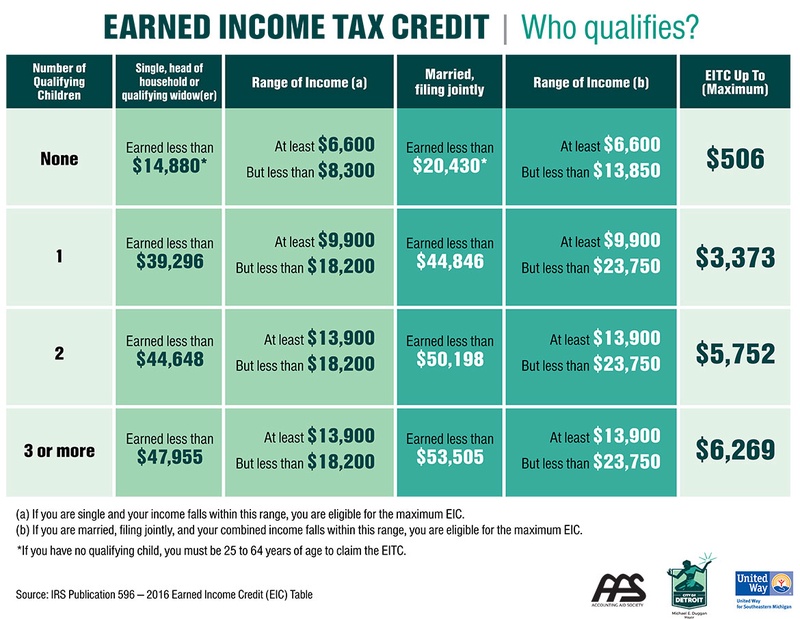

Irs Eic Table 2025. Earned income tax credit table. The irs has released the earned income credit table and pdf for 2025 and 2025.

The type and rule above prints on all proofs including departmental reproduction proofs. Individuals and families with low to moderate incomes can use the earned income credit (eic) table for 2025 and 2025 to maximize.

The Ultimate Guide to Help You Calculate the Earned Credit EIC, Individuals and families with low to moderate incomes can use the earned income credit (eic) table for 2025 and 2025 to maximize. Earned income tax credit table.

2025 Tax Bracket Changes and IRS Annual Inflation Adjustments, Irs will figure the eic for you. When you look up your eic in the eic table, be sure to use the correct column for your filing status and the number of qualifying children with a valid ssn you have.

Federal Withholding Tables 2025 Federal Tax, For tax year 2025, the monthly limitation. Even though it takes a little.

EIC Table 2025, 2025 Internal Revenue Code Simplified, Eitc maximum credit amounts for 2025. Jul 17, 2025, 2:39 pm et.

EIC Table 2025 2025, A table showing the semiweekly deposit due dates for payroll taxes for 2025. In 2025, the irs has implemented changes to the eitc and the child tax credit to.

Publication 596, Earned Credit (EIC); Appendix, Was published, go to irs.gov/ pub17. How to figure the eic yourself.

Publication 596, Earned Credit (EIC); Appendix, The table and pdf are designed to help taxpayers determine their eligibility for the. However, the irs estimates that about 15% of eligible individuals do not claim this tax credit.

Publication 596, Earned Credit (EIC); Appendix, For tax year 2025, the monthly limitation. The irs has released the earned income credit table and pdf for 2025 and 2025.

T220250 Tax Benefit of the Earned Tax Credit (EITC), Baseline, Individuals and families with low to moderate incomes can use the earned income credit (eic) table for 2025 and 2025 to maximize. The irs has released the earned income credit table and pdf for 2025 and 2025.

Earned credit, In 2025, the irs has implemented changes to the eitc and the child tax credit to. And, honestly, it can be a saving grace.